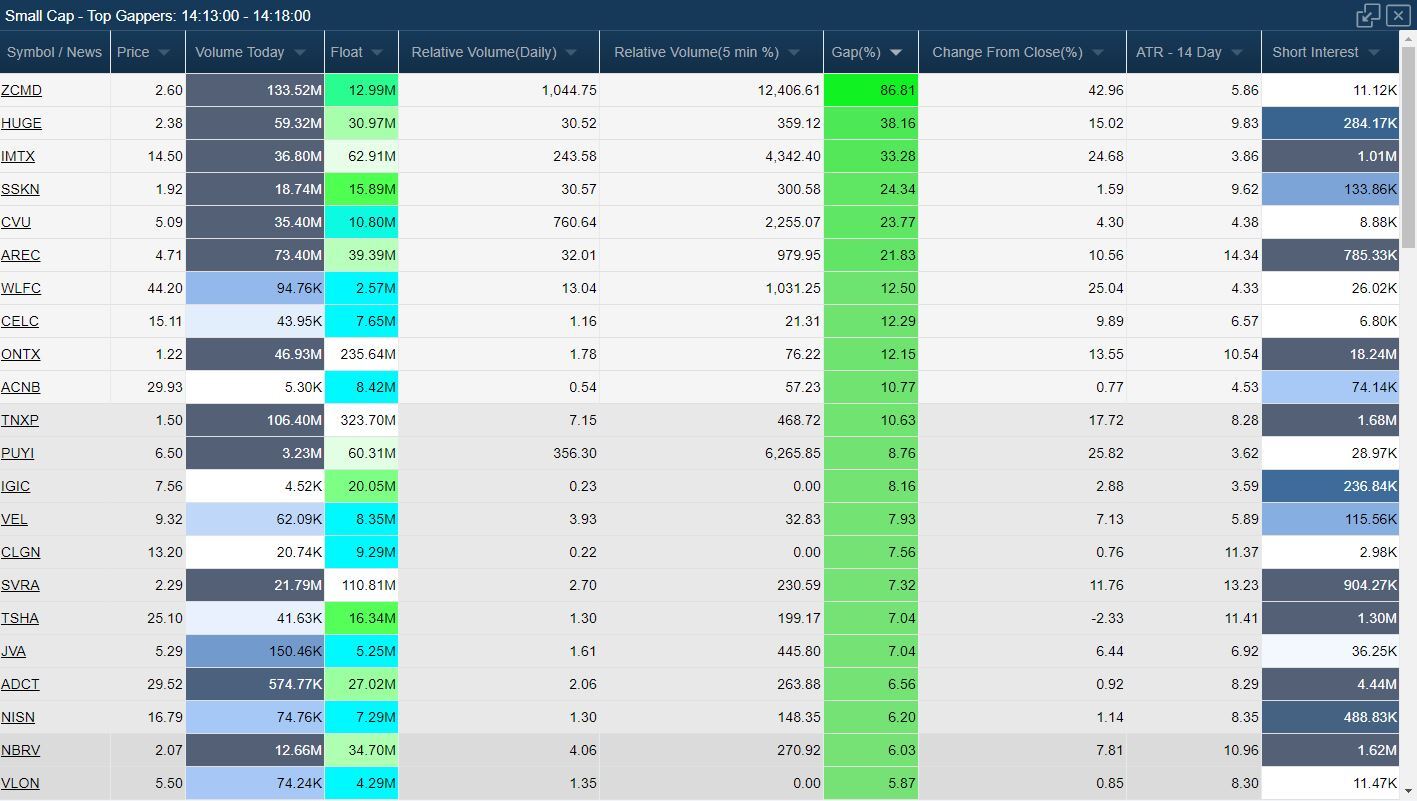

To start with, the vast majority of mainstream and larger asset management houses do not look at micro cap – a fact that has become even more accentuated since the bursting of the tech bubble. So why should micro cap be considered a hedge strategy at all, and why should micro cap funds get away with charging hedge fund fees? In fact, their investment behaviour is generally significantly closer to mutual funds in the long only sector, at least in the sense that they are predominantly long the market. However, with many of these stocks trading on thin volume, making shorting difficult, micro cap hedge funds rarely operate in the traditional manner of long/short equity funds. This leaves plenty of room for variety, with the market stretching from venture capital type startups in the high tech sector through to long established, if small, companies in traditional industries. While precise definitions of micro cap stocks vary, a good benchmark is the one ascribed by Morningstar: Market capitalisation of $350 million or less.

However, with over 3,000 micro cap stocks in the US alone and only around 50 funds, managers argue that there is value to be added from solid fundamental analysis in this oft neglected market. Most micro cap hedge funds are predominantly long biased, and some observers argue that in reality they are simply specialist traditional investors and not truly hedge at all. One of those is micro cap investing – a technique that has found itself so peripheral in the wider world of hedge funds that managers find themselves having to defend its place in the hedge arena at all. However, on the fringes of the hedge fund universe there remain some strategies that continue to fly under the radar of most investors. View the ‘Rules of the Game’ below to find out more about this market and how we intend to compile our list.While arguments continue to rage over just how mature the hedge fund market has become, it is difficult to argue that even the more esoteric strategies used by individual managers are becoming increasingly well known. It is our view that this list will continue to get better the more we refine our search.

#List micro cap stocks update#

We will update our list every Friday and publish any significant changes as they happen on our social media channels. We believe this is one of the most exciting investment opportunities available now.Īlso read our report here: Mining for Gold and other Valuable Treasure without a Shovel – The search for gold among the cryptocurrency carcasses It is our aim to select a number of micro cap cryptocurrencies that we consider offer excellent potential where we believe they have been both overlooked and overshadowed by their larger counterparts. This is a high risk high reward area of the cryptocurrency market where daily increases in value are often over 100%, however the opposite is also true. These are the cryptocurrencies with a market cap of under $3m, representing over 80% of all cryptocurrencies. From our own indepth research it is obvious there are huge rewards waiting for those who find the hidden gems among the many long forgotten and overlooked micro cap cryptocurrencies. However most of the action is in the top 6 (Bitcoin, Ether, XRP, Tether, Litecoin and Bitcoin Cash). There are over 6,000 listed cryptocurrencies.

0 kommentar(er)

0 kommentar(er)